All Categories

Featured

Table of Contents

Which one you select depends upon your requirements and whether the insurance company will certainly authorize it. Policies can likewise last until defined ages, which most of the times are 65. As a result of the various terms it provides, level life insurance policy supplies possible insurance holders with versatile alternatives. Past this surface-level details, having a higher understanding of what these plans require will certainly aid guarantee you buy a policy that meets your requirements.

Be conscious that the term you choose will certainly influence the premiums you spend for the plan. A 10-year level term life insurance plan will certainly set you back less than a 30-year policy because there's less chance of an incident while the plan is energetic. Reduced threat for the insurer corresponds to lower premiums for the insurance policy holder.

Your family members's age need to additionally affect your policy term option. If you have young kids, a longer term makes good sense due to the fact that it shields them for a longer time. Nevertheless, if your children are near the adult years and will certainly be monetarily independent in the future, a much shorter term could be a far better suitable for you than a lengthy one.

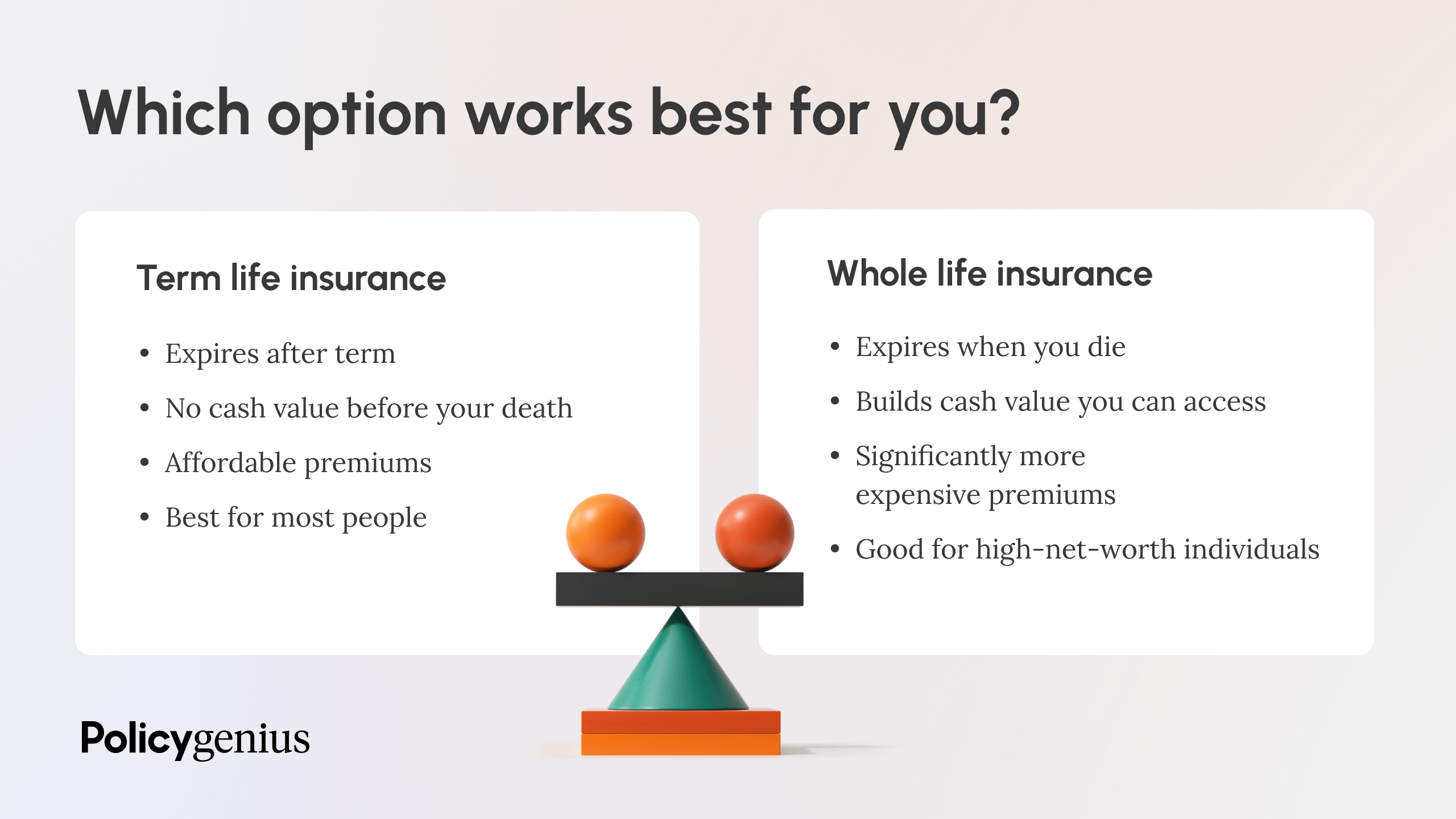

When contrasting entire life insurance coverage vs. term life insurance coverage, it deserves noting that the latter normally costs less than the former. The outcome is extra protection with reduced premiums, supplying the finest of both globes if you need a significant amount of protection yet can not afford a more pricey plan.

What is Short Term Life Insurance Coverage?

A degree survivor benefit for a term plan typically pays as a lump sum. When that occurs, your successors will certainly obtain the whole amount in a single repayment, which quantity is ruled out income by the IRS. Therefore, those life insurance proceeds aren't taxed. However, some degree term life insurance business permit fixed-period settlements.

Rate of interest settlements received from life insurance coverage plans are taken into consideration income and are subject to taxation. When your level term life policy runs out, a couple of different points can happen.

The disadvantage is that your renewable level term life insurance policy will come with greater premiums after its preliminary expiry. Ads by Money. We might be compensated if you click this ad. Ad For beginners, life insurance policy can be made complex and you'll have questions you desire responded to prior to devoting to any kind of policy.

Life insurance policy firms have a formula for determining threat using death and rate of interest (Term life insurance with accelerated death benefit). Insurance companies have hundreds of clients getting term life plans at the same time and utilize the costs from its active policies to pay making it through beneficiaries of various other policies. These companies utilize mortality tables to estimate the amount of people within a particular team will certainly file fatality claims annually, and that information is made use of to identify typical life span for potential insurance policy holders

Additionally, insurance provider can spend the cash they get from premiums and increase their income. Given that a level term plan does not have money value, as a policyholder, you can't invest these funds and they do not offer retirement revenue for you as they can with whole life insurance plans. Nevertheless, the insurance coverage firm can spend the cash and make returns.

The following area information the benefits and drawbacks of degree term life insurance coverage. Foreseeable costs and life insurance policy coverage Streamlined policy framework Possible for conversion to irreversible life insurance policy Limited protection duration No money worth accumulation Life insurance policy costs can boost after the term You'll discover clear benefits when contrasting level term life insurance policy to various other insurance coverage types.

What is Term Life Insurance With Accelerated Death Benefit? Understanding Its Purpose?

From the moment you take out a policy, your costs will certainly never ever change, aiding you plan monetarily. Your protection will not differ either, making these plans reliable for estate planning.

If you go this course, your costs will certainly raise yet it's constantly excellent to have some versatility if you wish to keep an energetic life insurance policy plan. Renewable level term life insurance policy is another alternative worth thinking about. These policies allow you to maintain your present plan after expiry, giving flexibility in the future.

What Exactly is Simplified Term Life Insurance?

You'll select a coverage term with the ideal level term life insurance rates, however you'll no much longer have protection once the strategy ends. This downside could leave you scrambling to find a new life insurance plan in your later years, or paying a premium to expand your current one.

Lots of entire, global and variable life insurance policy policies have a money value part. With one of those policies, the insurance provider deposits a part of your monthly costs payments right into a cash money value account. This account makes rate of interest or is spent, assisting it expand and provide a more considerable payment for your recipients.

With a degree term life insurance policy plan, this is not the instance as there is no money worth part. Because of this, your policy will not grow, and your death advantage will never raise, thus limiting the payment your recipients will certainly obtain. If you desire a policy that gives a fatality benefit and builds cash money value, check into whole, universal or variable strategies.

The second your plan runs out, you'll no much longer have life insurance policy protection. Degree term and reducing life insurance deal comparable policies, with the main distinction being the fatality advantage.

It's a kind of cover you have for a particular quantity of time, referred to as term life insurance. If you were to pass away throughout the time you're covered for (the term), your enjoyed ones receive a fixed payment agreed when you secure the plan. You simply choose the term and the cover amount which you could base, as an example, on the price of increasing youngsters up until they leave home and you might utilize the repayment in the direction of: Assisting to pay off your home mortgage, financial obligations, charge card or car loans Aiding to spend for your funeral prices Assisting to pay college fees or wedding event costs for your youngsters Helping to pay living costs, changing your income.

The Benefits of Choosing Level Benefit Term Life Insurance

The plan has no money value so if your payments quit, so does your cover. If you take out a degree term life insurance coverage policy you could: Select a dealt with amount of 250,000 over a 25-year term.

Latest Posts

Funeral Cover With No Waiting Period

Instant Term Life Insurance Rates

State Regulated Program To Pay For Final Expenses