All Categories

Featured

Table of Contents

A degree term life insurance policy policy can provide you assurance that individuals that rely on you will certainly have a fatality benefit during the years that you are preparing to support them. It's a means to assist care for them in the future, today. A degree term life insurance policy (in some cases called degree premium term life insurance policy) plan provides insurance coverage for a set number of years (e.g., 10 or two decades) while maintaining the premium repayments the same throughout of the policy.

With degree term insurance, the expense of the insurance will remain the very same (or possibly decrease if returns are paid) over the regard to your plan, normally 10 or two decades. Unlike irreversible life insurance policy, which never ever runs out as lengthy as you pay costs, a level term life insurance policy policy will finish eventually in the future, usually at the end of the period of your level term.

How Does Level Term Life Insurance Compare to Other Types?

As a result of this, lots of people utilize permanent insurance policy as a steady economic planning device that can offer several needs. You might have the ability to transform some, or all, of your term insurance coverage during a set period, normally the first ten years of your plan, without requiring to re-qualify for protection even if your health has actually altered.

As it does, you may wish to add to your insurance policy protection in the future. When you first obtain insurance coverage, you may have little cost savings and a huge mortgage. At some point, your savings will certainly expand and your home loan will certainly diminish. As this takes place, you might wish to at some point lower your death benefit or think about transforming your term insurance coverage to a permanent policy.

So long as you pay your premiums, you can relax easy understanding that your liked ones will certainly get a death benefit if you die throughout the term. Numerous term plans allow you the capability to convert to long-term insurance policy without having to take an additional health and wellness examination. This can allow you to make the most of the fringe benefits of an irreversible plan.

Degree term life insurance policy is among the most convenient courses into life insurance coverage, we'll talk about the advantages and disadvantages so that you can select a plan to fit your demands. Degree term life insurance coverage is one of the most typical and basic type of term life. When you're trying to find momentary life insurance policy plans, level term life insurance policy is one path that you can go.

The application process for level term life insurance is typically very uncomplicated. You'll complete an application that contains general individual info such as your name, age, etc in addition to a more detailed survey about your case history. Depending upon the plan you have an interest in, you may need to join a medical examination process.

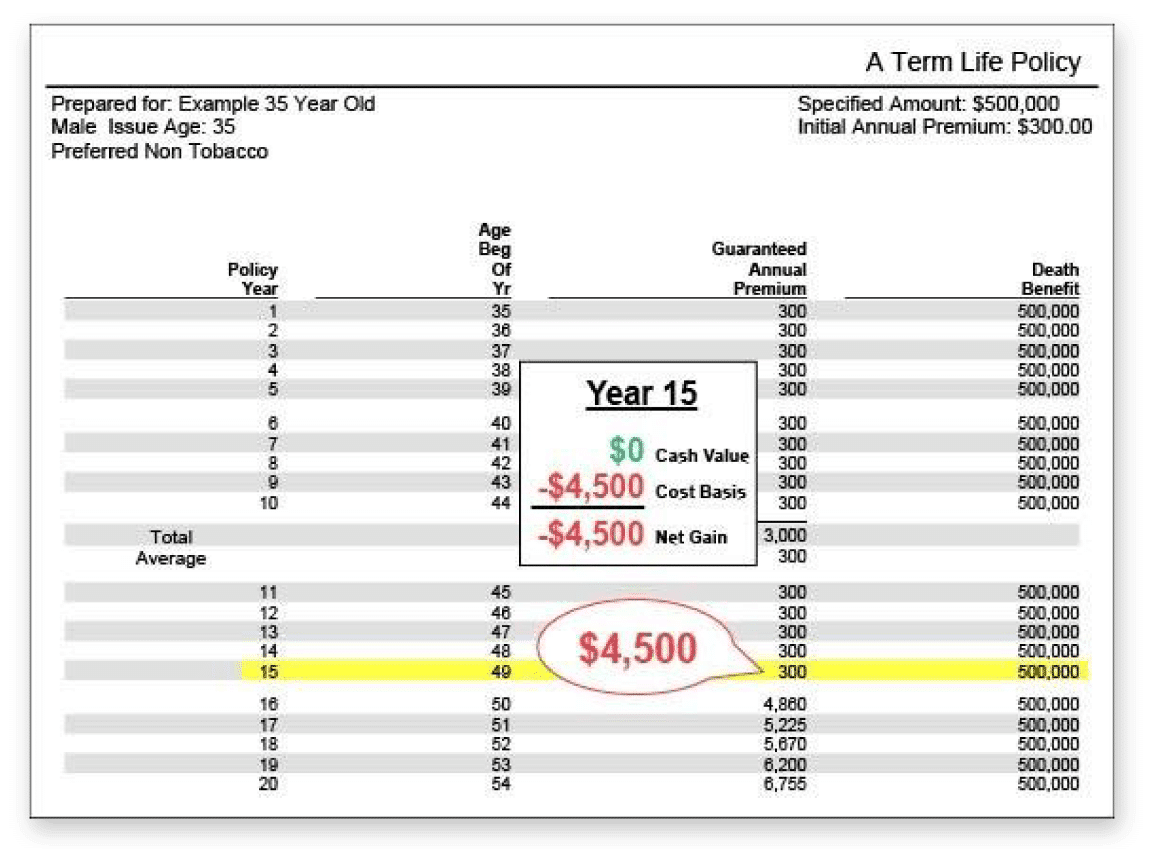

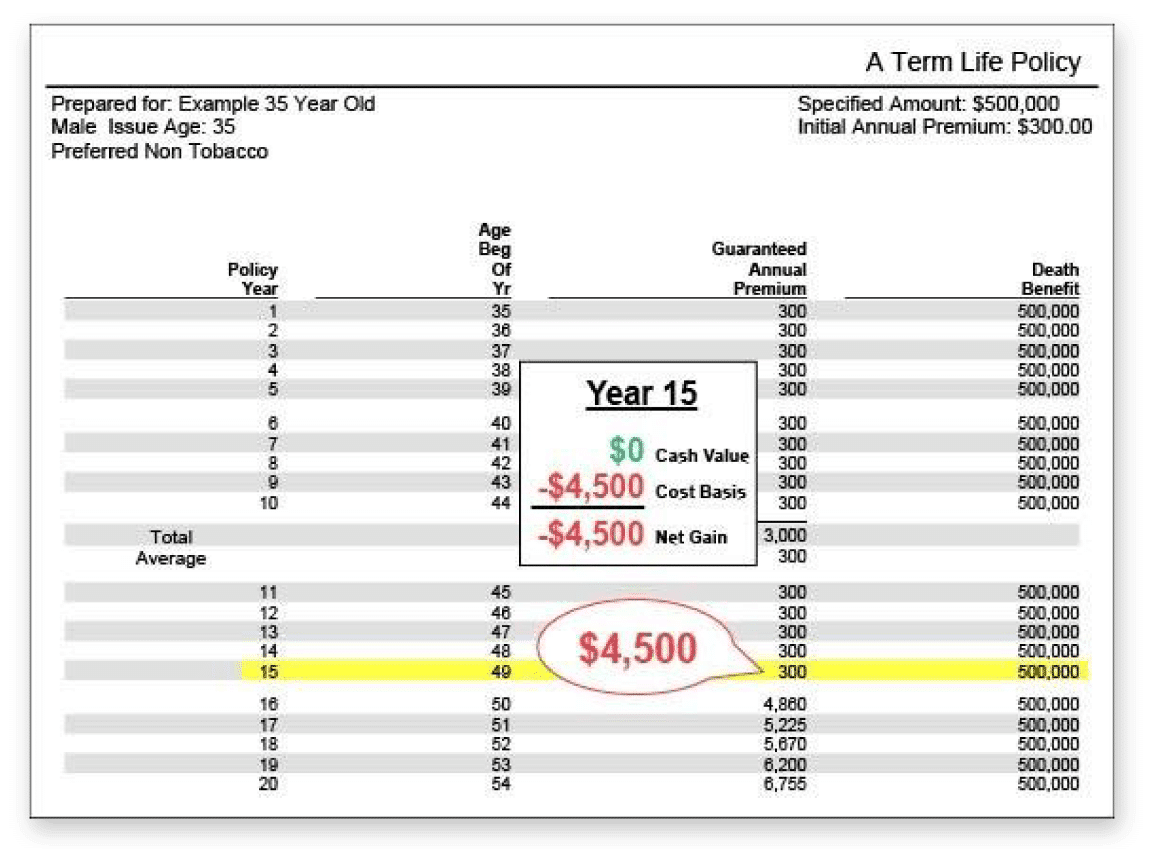

The short answer is no. A degree term life insurance plan doesn't construct money worth. If you're seeking to have a policy that you have the ability to withdraw or borrow from, you might check out permanent life insurance policy. Whole life insurance coverage plans, for instance, allow you have the comfort of survivor benefit and can accrue money value with time, suggesting you'll have a lot more control over your advantages while you live.

How Does Level Term Life Insurance Benefit Families?

Motorcyclists are optional stipulations added to your policy that can give you fringe benefits and defenses. Riders are a terrific method to add safeguards to your plan. Anything can occur over the training course of your life insurance policy term, and you wish to await anything. By paying just a bit more a month, riders can provide the assistance you need in instance of an emergency situation.

This rider gives term life insurance policy on your youngsters with the ages of 18-25. There are circumstances where these benefits are built right into your plan, yet they can also be readily available as a different addition that calls for extra payment. This motorcyclist gives an extra survivor benefit to your beneficiary should you die as the result of a crash.

Latest Posts

Funeral Cover With No Waiting Period

Instant Term Life Insurance Rates

State Regulated Program To Pay For Final Expenses