All Categories

Featured

Table of Contents

Insurance provider will not pay a small. Instead, consider leaving the cash to an estate or count on. For more in-depth information on life insurance get a copy of the NAIC Life Insurance Policy Purchasers Guide.

The internal revenue service puts a limit on how much money can enter into life insurance premiums for the plan and how quickly such costs can be paid in order for the plan to preserve all of its tax advantages. If certain restrictions are gone beyond, a MEC results. MEC insurance holders may be subject to tax obligations on distributions on an income-first basis, that is, to the degree there is gain in their plans, in addition to charges on any taxable amount if they are not age 59 1/2 or older.

Please note that superior finances build up interest. Earnings tax-free therapy likewise presumes the car loan will at some point be satisfied from income tax-free death benefit earnings. Fundings and withdrawals reduce the policy's money worth and survivor benefit, may create specific plan benefits or motorcyclists to end up being inaccessible and may increase the opportunity the policy may gap.

4 This is offered with a Long-lasting Treatment Servicessm motorcyclist, which is readily available for a service charge. In addition, there are restrictions and restrictions. A customer might get approved for the life insurance coverage, yet not the cyclist. It is paid as a velocity of the survivor benefit. A variable global life insurance agreement is a contract with the main function of supplying a death benefit.

What is the most popular Estate Planning plan in 2024?

These profiles are very closely managed in order to satisfy stated financial investment objectives. There are costs and fees connected with variable life insurance coverage contracts, including mortality and threat costs, a front-end lots, management fees, financial investment administration charges, abandonment fees and fees for optional bikers. Equitable Financial and its affiliates do not give lawful or tax guidance.

And that's great, because that's exactly what the death advantage is for.

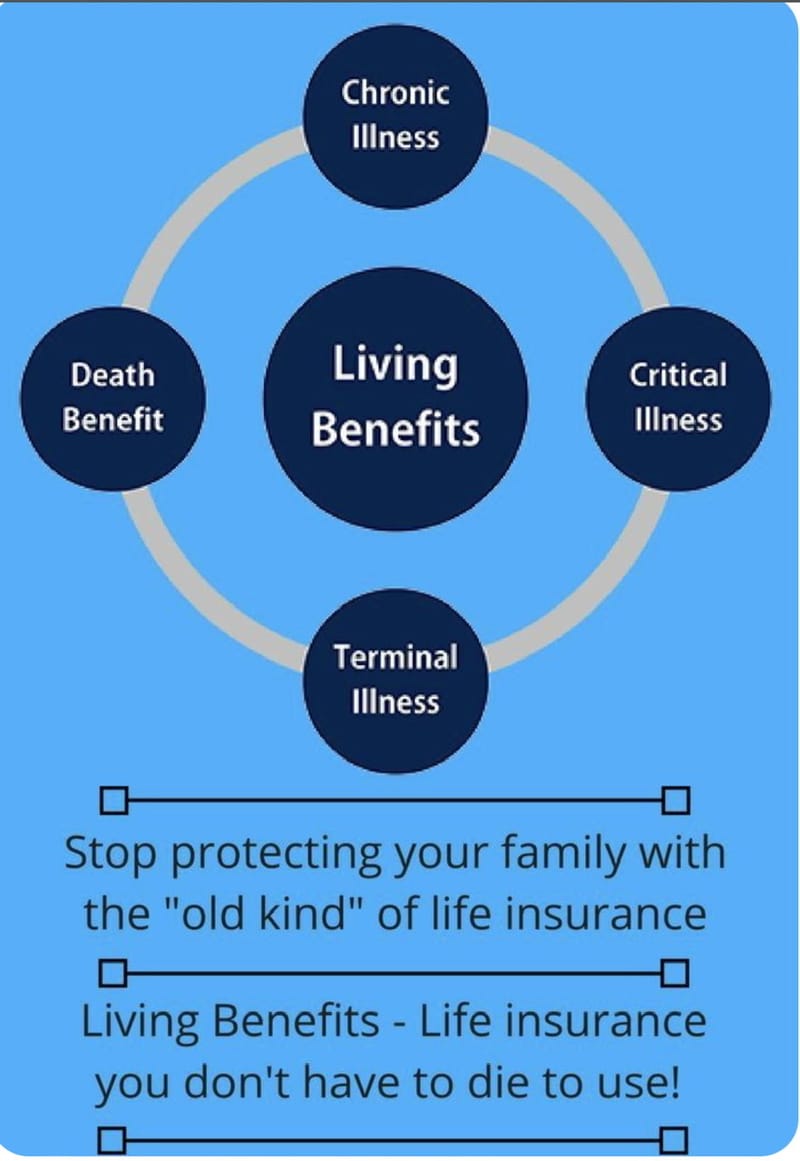

What are the advantages of whole life insurance policy? Right here are several of the crucial things you ought to recognize. One of the most enticing advantages of purchasing an entire life insurance policy policy is this: As long as you pay your premiums, your fatality benefit will certainly never run out. It is ensured to be paid regardless of when you die, whether that's tomorrow, in 5 years, 80 years or also additionally away. Term life.

Assume you do not require life insurance policy if you don't have children? You might intend to reconsider. It may feel like an unnecessary expense. Yet there are several advantages to living insurance, also if you're not supporting a household. Here are 5 reasons that you must buy life insurance policy.

Who offers flexible Level Term Life Insurance plans?

Funeral expenditures, interment prices and clinical expenses can include up. Irreversible life insurance coverage is readily available in numerous quantities, so you can select a death benefit that fulfills your demands.

Establish whether term or irreversible life insurance coverage is right for you. As your personal situations modification (i.e., marital relationship, birth of a kid or work promo), so will your life insurance requires.

For the a lot of part, there are 2 kinds of life insurance policy plans - either term or long-term strategies or some mix of the 2. Life insurance providers offer numerous types of term strategies and traditional life plans in addition to "interest sensitive" items which have actually become more common given that the 1980's.

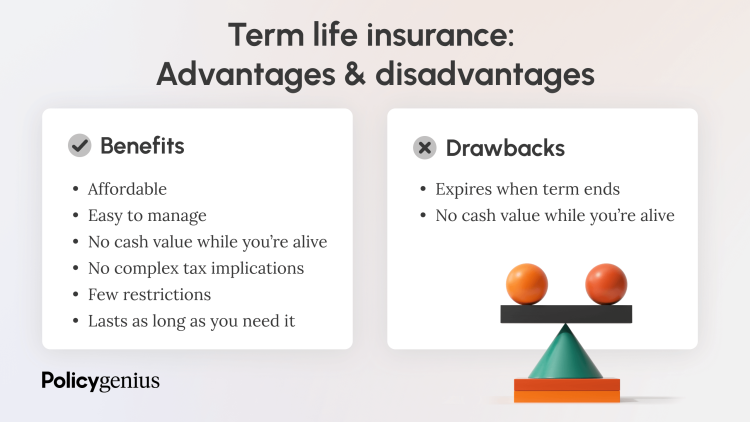

Term insurance gives security for a specific time period. This duration can be as short as one year or offer insurance coverage for a specific number of years such as 5, 10, 20 years or to a specified age such as 80 or in some situations up to the earliest age in the life insurance policy mortality tables.

How long does Trust Planning coverage last?

Presently term insurance rates are really affordable and amongst the most affordable historically experienced. It should be noted that it is a widely held belief that term insurance is the least pricey pure life insurance policy coverage readily available. One needs to evaluate the plan terms carefully to make a decision which term life choices appropriate to satisfy your specific conditions.

With each new term the premium is increased. The right to restore the plan without evidence of insurability is a vital benefit to you. Otherwise, the threat you take is that your health and wellness may weaken and you might be unable to obtain a policy at the exact same rates or even whatsoever, leaving you and your recipients without protection.

You should exercise this choice during the conversion period. The length of the conversion duration will certainly vary depending on the sort of term policy purchased. If you convert within the prescribed duration, you are not needed to offer any kind of details regarding your health. The premium price you pay on conversion is normally based on your "present obtained age", which is your age on the conversion day.

Under a level term policy the face quantity of the plan stays the same for the whole period. Frequently such policies are sold as home loan protection with the quantity of insurance coverage lowering as the balance of the home loan decreases.

What happens if I don’t have Premium Plans?

Generally, insurance providers have actually not deserved to change premiums after the plan is sold. Because such policies may continue for years, insurers must utilize conventional death, passion and cost price price quotes in the costs estimation. Adjustable premium insurance policy, nonetheless, permits insurance companies to use insurance at reduced "present" premiums based upon less conventional presumptions with the right to alter these premiums in the future.

While term insurance coverage is developed to offer protection for a specified period, irreversible insurance coverage is designed to give coverage for your entire lifetime. To keep the premium price degree, the costs at the more youthful ages surpasses the real expense of protection. This added premium develops a reserve (money worth) which helps pay for the policy in later years as the expense of security increases above the premium.

Under some policies, costs are called for to be spent for a set number of years. Under various other plans, costs are paid throughout the insurance policy holder's life time. The insurance policy firm spends the excess premium dollars This kind of plan, which is sometimes called cash money worth life insurance policy, produces a cost savings aspect. Cash values are important to a long-term life insurance policy plan.

Latest Posts

Funeral Cover With No Waiting Period

Instant Term Life Insurance Rates

State Regulated Program To Pay For Final Expenses